Alfred, a one-third profits and capital partner in Pizzeria Partnership, needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for Year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of Year 2 of the partnership was $23,140. Thankfully, Alfred still has his Schedule K-1 from the partnership for Years 1 and 2.

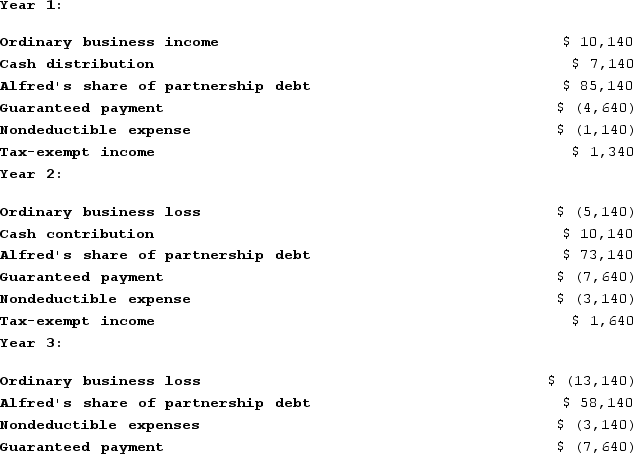

Using the following information from Alfred's Year 1, Year 2, and Year 3 Schedule K-1, calculate his tax basis the end of Year 2 and Year 3.

Definitions:

Development Requirement

Conditions that must be met for a region or country to achieve economic growth, including infrastructure, education, and healthcare.

Inflation Rate

The percentage increase in the price level of goods and services in an economy over a period of time, typically measured on an annual basis.

Government Control

Government control refers to the mechanisms, regulations, and actions taken by a government to oversee, direct, or manage its country's economic activities, industries, or individual behavior.

Public Outlays

Government spending or expenditure, including costs on public services, infrastructure, and social welfare programs.

Q2: What is the unextended due date of

Q5: A nurse is caring for a client

Q42: A liquidation of a corporation always is

Q47: This year, Reggie's distributive share from Almonte

Q61: A corporation undertakes a valuation allowance analysis

Q68: For book purposes, RadioAircast Incorporated reported $15,000

Q72: Price Corporation reported pretax book income of

Q76: Longhorn Company reports current E&P of $115,000

Q92: Decena Corporation manufactures one product. It does

Q129: Which of the following items is subject