Alfred, a one-third profits and capital partner in Pizzeria Partnership, needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for Year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of Year 2 of the partnership was $23,140. Thankfully, Alfred still has his Schedule K-1 from the partnership for Years 1 and 2.

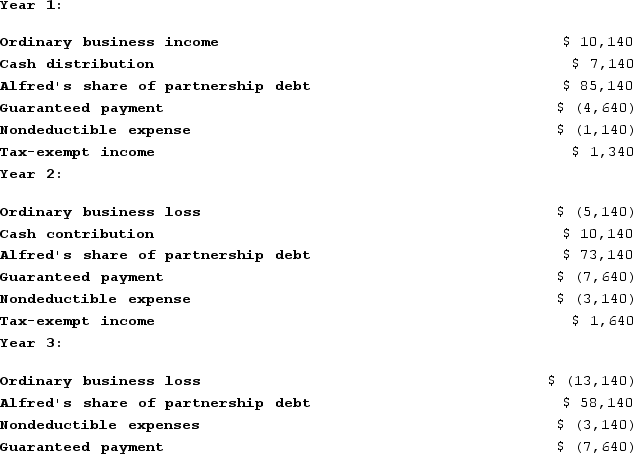

Using the following information from Alfred's Year 1, Year 2, and Year 3 Schedule K-1, calculate his tax basis the end of Year 2 and Year 3.

Definitions:

Chaotic Startup

An early stage in a business characterized by disorder and unpredictability as it seeks to establish its operations.

Legal Aspects

Components related to laws and regulations that impact businesses and their operations.

Board of Advisors

A group of experienced individuals selected to provide strategic advice and guidance to the management of an organization.

Liability

A financial obligation or responsibility that an individual or entity owes, which may result in the future sacrifice of economic benefits.

Q4: Billie transferred her 20 percent interest to

Q8: ER General Partnership, a medical supplies business,

Q48: C corporations with annual average gross receipts

Q55: Inez transfers property with a tax basis

Q73: Don and Marie formed Paper Lilies Corporation

Q74: Which of the following statements is true?<br>A)

Q108: Green Corporation reported pretax book income of

Q282: Kita Corporation manufactures one product. It does

Q405: Motts Incorporated has a standard cost system

Q408: Jungman Incorporated has provided the following data