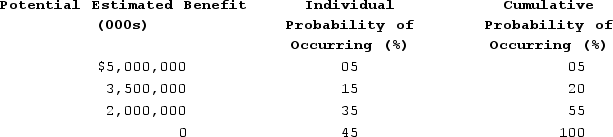

Acai Corporation determined that $5,000,000 of its R&D credit on its current-year tax return was uncertain. Acai determined that there was a 40 percent chance of the credit being sustained on audit. Management made the following assessment of the company's potential tax benefit from the R&D credit and its probability of occurring.

Under ASC 740, what amount of the tax benefit related to the R&D credit can Acai recognize in calculating its income tax provision in the current year?

Under ASC 740, what amount of the tax benefit related to the R&D credit can Acai recognize in calculating its income tax provision in the current year?

Definitions:

Purchases Returns and Allowances

Refers to a reduction in the cost of purchases due to items being returned or allowances provided by the seller for damaged or unsatisfactory goods.

Merchandise Inventory

Goods that a company holds for the purpose of sale to customers in the ordinary course of business.

Merchandise Inventory

Goods or products that a company holds for the main purpose of selling them to customers.

Balance Sheet

The balance sheet is a financial statement that provides a snapshot of a company's financial position, listing assets, liabilities, and shareholders' equity at a specific point in time.

Q1: In 2020 Webtel Corporation donated $50,000 to

Q3: The tax basis of property received by

Q17: S corporation shareholders are subject to self-employment

Q43: Bonnie Jo purchased a used camera (five-year

Q56: On April 18, 20X8, Robert sold his

Q63: Daschle LLC completed some research and development

Q67: The deduction for business interest expense is

Q95: Taxpayers can recognize a taxable gain on

Q105: Whitman Corporation reported pretax book income of

Q113: Butte sold a machine to a machine