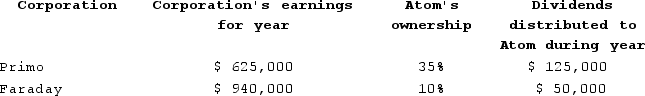

Atom Ventures Incorporated (AV) owns stock in the Primo and Faraday corporations. The following summarizes information relating to AV's investment in Primo and Faraday as follows:

Assuming that AV follows the general rules for reporting its income from these investments and the value of AV's stock investments in Primo and Faraday is equal to AV's basis in these investments, what is the amount of AV's book-tax difference associated with the investment in these corporations (disregarding the dividends received deduction)? Is it favorable or unfavorable? Is it permanent or temporary?

Assuming that AV follows the general rules for reporting its income from these investments and the value of AV's stock investments in Primo and Faraday is equal to AV's basis in these investments, what is the amount of AV's book-tax difference associated with the investment in these corporations (disregarding the dividends received deduction)? Is it favorable or unfavorable? Is it permanent or temporary?

Definitions:

Q5: Assume that Yuri acquires a competitor's assets

Q12: Tristan transfers property with a tax basis

Q17: S corporation shareholders are subject to self-employment

Q38: Danny owns an electronics outlet in Dallas.

Q42: Which legal entity provides the least flexible

Q56: The full-inclusion method requires cash-basis taxpayers to

Q65: Simone transferred 100 percent of her stock

Q70: Which of the following is not an

Q79: The adjusted basis is the initial basis

Q112: Beltway Company is owned equally by George,