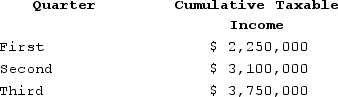

In the current year, Auto Rent Corporation reported the following taxable income at the end of its first, second, and third quarters: (Use Exhibit 16-10)

What amount of estimated tax payments would Auto Rent pay each quarter to avoid estimated tax penalties under the annualized income method of computing estimated tax payments?

What amount of estimated tax payments would Auto Rent pay each quarter to avoid estimated tax penalties under the annualized income method of computing estimated tax payments?

Definitions:

LMX

Leader-Member Exchange, a theory focusing on the two-way relationship between supervisors and subordinates, emphasizing dyadic relationships.

Social Exchange Theory

A theoretical perspective that views social relationships as transactions where individuals seek to maximize their benefits while minimizing their costs.

Leader-Member Exchange Theory

A concept that centers on the relationship between leaders and their followers, emphasizing the effect of these dynamics on work outcomes.

Relationship

A connection, association, or involvement between two or more parties, individuals, or entities.

Q45: Lansing Company is owned equally by Jennifer,

Q55: Jorge purchased a copyright for use in

Q91: iScope Incorporated paid $3,000 in interest on

Q92: Business assets that tend to be used

Q100: Which of the following realized gains results

Q103: Joe operates a plumbing business that uses

Q104: Don operates a taxi business, and this

Q110: Purple Rose Corporation reported pretax book income

Q114: The sale of computer equipment used in

Q121: Otto operates a bakery and is on