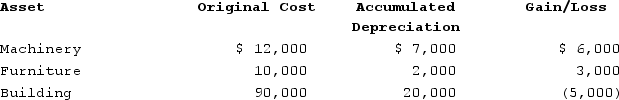

Andrew, an individual, began business four years ago and has never sold a §1231 asset. Andrew owned each of the assets for several years. In the current year, Andrew sold the following business assets:

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Definitions:

IFRS

International Financial Reporting Standards (IFRS) are a set of accounting standards developed by the International Accounting Standards Board (IASB) that aim to bring consistency to accounting language, practices, and statements globally.

Reserves

Funds or assets set aside to cover future expenses, losses, or liabilities.

Asset Revaluations

The process of adjusting the book value of a company's assets to reflect their current market values.

Stated Value

A value assigned to no-par value stock by the company's board of directors, used as a basis for accounting and financial reporting.

Q4: A business generally adopts a fiscal or

Q8: Misha traded computer equipment used in her

Q21: Jones operates an upscale restaurant and he

Q52: The estate and gift taxes share several

Q54: David purchased a deli shop on February

Q59: Crescent Corporation is owned equally by George

Q70: Deductible interest expense incurred by a U.S.

Q74: This year Nicholas earned $500,000 and used

Q116: For tax purposes, companies using nonqualified stock

Q129: This year Nicholas earned $536,000 and used