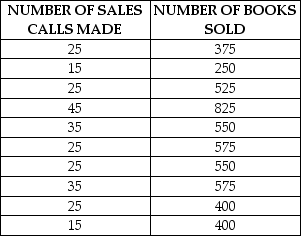

Table 8.3

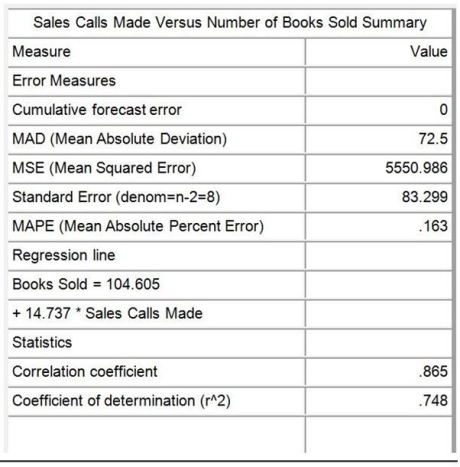

A textbook publisher for books used in business schools believes that the number of books sold is related to the number of campus visits to decision makers made by their sales force. A sampling of the number of sales calls made and the number of books sold is shown in the following table.

-Use the information provided in Table 8.3. What percent in the variation of the variable Books Sold is explained by the value of the variable Sales Calls Made?

Definitions:

Income Statement

A financial document that shows a company's revenues, expenses, and net income over a specific period.

Unit Product Cost

The total cost associated with producing one unit of product, including materials, labor, and overhead.

Variable Manufacturing Overhead

The portion of manufacturing overhead costs that varies directly with production volume.

Variable Costing

Accounting practice that integrates only variable cost elements of production (direct materials, direct labor, and variable manufacturing overhead) into the valuation of products.

Q36: _ is a computerized information system developed

Q45: Use the information in Figure 5.1. Where

Q54: How can group technology be used in

Q57: Use the information in Table 10.5. What

Q71: Use the information in Scenario 9.3. What

Q74: Use the information in Figure 5.1. What

Q74: Briefly discuss the House of Toyota, including

Q88: Heidi was part of a project team

Q92: Use the information provided in Table 8.4.

Q145: Refer to Scenario 9.1. The net impact