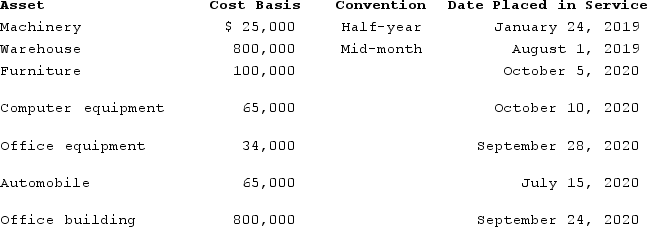

BoxerLLC has acquired various types of assets recently used 100 percent in its trade or business. Below is a list of assets acquired during 2019 and 2020:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2019, but would like to take advantage of the §179 expense and bonus depreciation for 2020 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation deduction for 2020. (Use MACRS Table 1, MACRS Table 5, and Exhibit 10-10.) (Round final answer to the nearest whole number.)

Boxer did not elect §179 expense and elected out of bonus depreciation in 2019, but would like to take advantage of the §179 expense and bonus depreciation for 2020 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation deduction for 2020. (Use MACRS Table 1, MACRS Table 5, and Exhibit 10-10.) (Round final answer to the nearest whole number.)

Definitions:

Coevolution

The reciprocal adaptation of two or more species that occurs as a result of their close interactions over a long period.

Bat-pollinated

Refers to plants that are primarily pollinated by bats, a process crucial for the reproductive success of certain plant species.

Night-blooming

Night-blooming characterizes plants that open their flowers or become active during the night, often for reasons such as attracting specific pollinators or conserving water.

Pollinator

An organism that moves pollen from the male anthers of a flower to the female stigma to achieve fertilization and produce seeds.

Q14: The deduction for qualified business income applies

Q24: Only accelerated depreciation is recaptured for §1245

Q32: Which of the following statements regarding incentive

Q35: Obispo, Incorporated, a U.S. corporation, received the

Q40: Sarah sold 1,000 shares of stock to

Q40: Ricardo transferred $1,225,000 of cash to State

Q46: Judy is a self-employed musician who performs

Q51: The exemption equivalent was repealed in 2010.

Q73: A Japanese corporation owned by 11 U.S.

Q121: A gross receipts tax is subject to