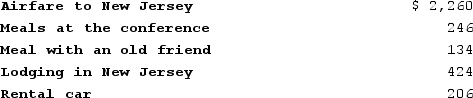

Shelley is self-employed in Texas and recently attended a two-day business conference in New Jersey. After Shelley attended the conference, she had dinner with an old friend who lived nearby. Shelley documented her expenditures (described below) . What amount can Shelley deduct?

Definitions:

Inner Tensions

Internal conflicts or stresses that an individual experiences, often due to opposing desires or needs.

Moral Development

The process through which individuals evolve in their understanding of morals, ethical standards, and values, determining how they reason about moral decisions.

Authority

The power or right to give orders, make decisions, and enforce obedience, often within a specific context or hierarchy.

Personal Values

Fundamental values or ethics that steer a person's actions and choices.

Q19: When creating an estate tax planning strategy,

Q31: Boot is not like-kind property involved in

Q33: Differences in voting powers are permissible across

Q53: Which of the following is not a

Q69: Gordon operates the Tennis Pro Shop in

Q77: The all-events test for income determines the

Q78: Sequoia purchased the rights to cut timber

Q83: Holmdel, Incorporated, a U.S. corporation, received the

Q86: The sale for more than the original

Q124: The phrase "ordinary and necessary" has been