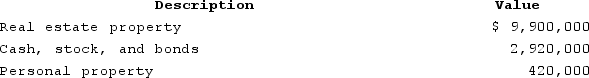

Sophia is single and owns the following property:

Sophia owns the real property in joint tenancy with Daniel. They purchased the property several years ago for $2.2 million. Sophia was only able to provide $440,000 of the purchase price. If Sophia dies, what is the amount of her gross estate?

Sophia owns the real property in joint tenancy with Daniel. They purchased the property several years ago for $2.2 million. Sophia was only able to provide $440,000 of the purchase price. If Sophia dies, what is the amount of her gross estate?

Definitions:

Market Conditions

Market conditions refer to the various factors that influence the supply and demand dynamics in a particular market, affecting prices and availability.

Economic Trends

Patterns or movements in economic indicators such as GDP, unemployment rates, or consumer confidence that indicate the general direction of an economy.

Taxation Depreciation

The allowance for the depreciation of assets that can be deducted from taxable income for tax purposes.

Accounting Depreciation

Accounting depreciation is the systematic allocation of the cost of a tangible asset over its useful life, reflecting its consumption, wear and tear, or obsolescence.

Q12: No deductions are allowed when calculating the

Q19: Which of the following transactions engaged in

Q28: The applicable credit is designed to:<br>A) apply

Q50: All taxes paid to a foreign government

Q55: At his death Titus had a gross

Q62: The IRS may consent to an early

Q77: Alexis transferred $400,000 to a trust with

Q107: What is the character of land used

Q117: Ashley owns a whole-life insurance policy worth

Q129: Regarding debt, S corporation shareholders are deemed