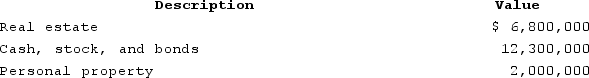

At his death in 2020, Nathan owned the following property:

The real estate is subject to a $2,025,000 mortgage and Nathan made taxable gifts in 2009 totaling $3.8 million, at which time he offset the gift tax with an applicable credit (exemption equivalent of $3.8 million). Nathan has never been married. What is the amount of his estate tax due? (Use Exhibit 14-1.)

The real estate is subject to a $2,025,000 mortgage and Nathan made taxable gifts in 2009 totaling $3.8 million, at which time he offset the gift tax with an applicable credit (exemption equivalent of $3.8 million). Nathan has never been married. What is the amount of his estate tax due? (Use Exhibit 14-1.)

Definitions:

Natural Rate

The equilibrium unemployment rate arising from all sources except cyclical fluctuations, often considered the normal level of unemployment in an economy.

Continuous Inflation

Continuous inflation refers to a sustained increase in the general price level of goods and services in an economy over a period of time, eroding purchasing power.

Natural Rate of Unemployment

The level of unemployment that is expected in an economy without temporary fluctuations, often seen as the equilibrium state of the labor market.

Inverse Relationship

A situation where two variables move in opposite directions, meaning when one variable increases, the other decreases.

Q9: Taylor LLC purchased an automobile for $55,000

Q31: Gordon operates the Tennis Pro Shop in

Q36: Harold and Mary are married and live

Q65: Jackson is a 30percent partner in the

Q69: The United States generally taxes U.S. source

Q81: Andrea transferred $677,500 of stock to a

Q85: Which of the following statements regarding disproportionate

Q87: Which is not an allowable method under

Q101: Used property is eligible for bonus depreciation.

Q125: The MACRS recovery period for automobiles and