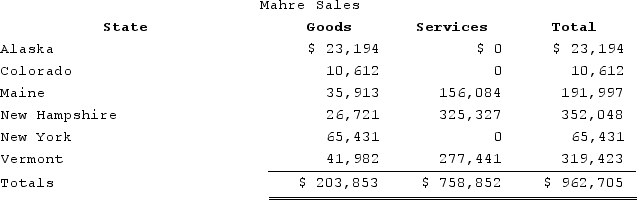

Mahre, Incorporated, a New York corporation, runs ski tours in a several states. Mahre also has a New York retail store and an Internet store, which ships to out-of-state customers. Assume sales transactions in all states, except New York, are under 200 and that all states have adopted Wayfair legislation. The ski tours operate in Maine, New Hampshire, and Vermont, where Mahre has employees and owns and uses tangible personal property. Mahre has real property only in New York. Mahre has the following sales:  Assume the following sales tax rates: Alaska (0 percent) , Colorado (7.75 percent) , Maine (8.5 percent) , New Hampshire (0 percent) , New York (8 percent) , and Vermont (5 percent) . How much sales and use tax must Mahre collect and remit?

Assume the following sales tax rates: Alaska (0 percent) , Colorado (7.75 percent) , Maine (8.5 percent) , New Hampshire (0 percent) , New York (8 percent) , and Vermont (5 percent) . How much sales and use tax must Mahre collect and remit?

Definitions:

One-way ANOVA

A statistical test used to compare the means of three or more independent groups to see if there’s a statistically significant difference.

Drug Experimentation

The act of trying or testing new pharmaceutical substances to observe their effects, often in controlled clinical trials.

Null Hypothesis

A statement of no effect or no difference, which researchers aim to test against the alternative hypothesis.

One-way ANOVA

A statistical test used to determine if there are any statistically significant differences between the means of three or more independent (unrelated) groups.

Q8: Tatia's basis in her TRQ Partnership interest

Q9: The three major societal issues that companies

Q18: Internal business ventures rather than external mergers,

Q23: Which of the following statements regarding the

Q29: Amy is a U.S. citizen. During the

Q38: Acquisition is the preferred mode of diversification

Q60: Judy is a self-employed musician who performs

Q89: Under which of the following scenarios could

Q94: Tyson is a 25percent partner in the

Q96: Holmdel, Incorporated, a U.S. corporation, received the