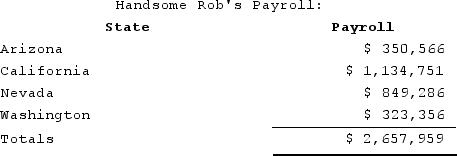

Handsome Rob provides transportation services in several western states. Rob has payroll as follows:  Rob is a California corporation and the following is true:

Rob is a California corporation and the following is true:

Rob hasincome tax nexus in Arizona, California, Nevada, and Washington. The Washington drivers spend 25 percent of their time driving through Oregon. California payroll includes $201,800 of payroll for services provided in Nevada by California-based drivers. What is Rob's California payroll numerator?

Definitions:

Staphylococcal Pneumonia

A type of pneumonia caused by the staphylococcus bacteria, characterized by inflammation and fluid accumulation in the lungs.

Congestive Heart Failure

A chronic condition where the heart is unable to pump blood effectively, leading to fluid buildup around the heart and throughout the body.

Antitussive Agents

Medications designed to suppress coughing.

Respiratory Acidosis

A condition characterized by an excess of carbon dioxide in the bloodstream, leading to decreased blood pH, often due to impaired lung function.

Q4: In a more complex business environment where

Q7: U.S. corporations are eligible for a foreign

Q19: When creating an estate tax planning strategy,

Q49: Roxy operates a dress shop in Arlington,

Q56: One of the tax advantages toan individual

Q85: Assume that at the end of 2020,

Q87: Jackson is the sole owner of JJJ

Q111: During 2020, MVC operated as a C

Q126: The estimated tax payment rules for S

Q131: A bypass provision in a will requires