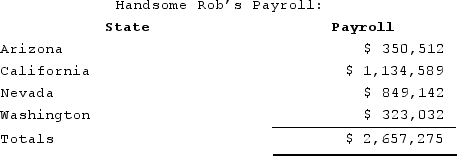

Handsome Rob provides transportation services in several western states. Rob has payroll as follows:  Rob is a California corporation and the following is true:

Rob is a California corporation and the following is true:

Rob has income tax nexus in Arizona, California, Nevada, and Washington. The Washington drivers spend 25 percent of their time driving through Oregon. California payroll includes $200,000 of payroll for services provided in Nevada by California-based drivers. What is Rob's California payroll numerator?

Definitions:

Expensive Jewelry

High-value personal adornments made from precious metals and stones, characterized by high cost and quality.

Ethical Wall

A term that refers to the procedures used to create a screen around an attorney, a paralegal, or another member of a law firm to shield him or her from information about a case in which there is a conflict of interest.

Specific Attorney

A designated lawyer chosen based on their expertise or the specificity of their legal practice.

Conflict of Interest

A situation in which a person or entity is involved in multiple interests, financial or otherwise, and serving one interest could involve working against another, typically compromising the decision-making process.

Q8: For shareholder value maximization to be a

Q28: Scott is a 50 percent partner in

Q31: Under the book value method of allocating

Q50: Ranger Athletic Equipment uses the accrual method

Q89: Most services are sourced to the state

Q91: A couple who is married at the

Q105: Big Homes Corporation is an accrual-method calendar-year

Q110: Public Law 86-272 protects solicitation from income

Q113: Many states are either starting to or

Q126: The estimated tax payment rules for S