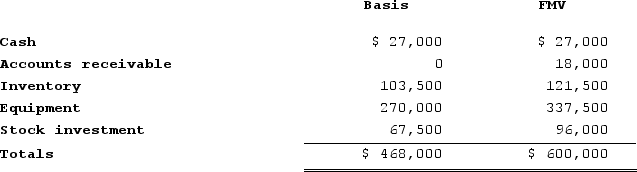

Victor is a one-third partner in the VRX Partnership, with an outside basis of $156,000 on January 1. Victor sells his partnership interest to Raj on January 1 for $200,000 cash. The VRX Partnership has the following assets and no liabilities as of January 1:

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased seven years ago. What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased seven years ago. What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

Definitions:

Ownership of Partnership

Ownership of a partnership refers to the proportionate share of rights, interests, and responsibilities in a partnership business, held by each partner.

Bonita's Share

A specific portion or allotment of a larger amount or entity that is designated or attributed to a person named Bonita.

Whole Business

A term often used in finance and economics referring to considering all aspects and operations of a business entity as a total entity.

Hockey Team

A hockey team is a group of players who compete together in the sport of hockey, governed by rules and often part of a league or competition.

Q2: The main reason that a strategic alliance

Q10: Pierre Corporation has a precredit U.S. tax

Q12: Super Sadie, Incorporated, manufactures sandals and distributes

Q22: Industries change mainly as a result of:<br>A)Government

Q24: To successfully transition from mass manufacturing to

Q36: Firm and markets represent the two primary

Q44: Open innovation is based upon the assumption

Q69: The United States generally taxes U.S. source

Q97: Portland Corporation is a U.S. corporation engaged

Q118: S corporation shareholders are not allowed to