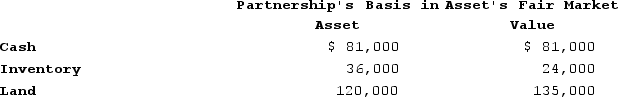

Doris owns a one-third capital and profits interest in the calendar-year DB Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $20,000. On that date, she receives an operating distribution of her share of partnership assets shown below:

What is the amount and character of Doris's gain or loss on the distribution? What is her basis in the distributed assets?

What is the amount and character of Doris's gain or loss on the distribution? What is her basis in the distributed assets?

Definitions:

Sales Territories

Specified geographical areas or customer groups assigned to a salesperson or team to target for selling a company's products or services.

Custom Architectural Pieces

Unique, made-to-order architectural elements tailored to specific design requirements or preferences.

Global Consumer Products

Goods and services designed and marketed to appeal to customers in multiple countries around the world.

Undifferentiated Selling

refers to a marketing strategy where the same product or message is presented to all customers, without any customization or segmentation.

Q3: In video cassette recorders (VCRs), Matsushita's VHS

Q10: When competition is international, competitive advantage depends

Q14: A §754 election is made by a

Q16: Inventory is substantially appreciated if the fair

Q19: Holding companies are organizational forms that exist

Q21: Jamie Dimon's comment, "I'd rather have first-rate

Q26: The main business of the Coca-Cola Company

Q37: The foreign tax credit regime is the

Q39: The main cause of downsizing, refocusing, and

Q135: Gordon operates the Tennis Pro Shop in