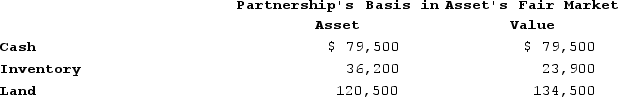

Doris owns a one-third capital and profits interest in the calendar-year DB Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $20,100. On that date, she receives an operating distribution of her share of partnership assets shown below:

What is the amount and character of Doris's gain or loss on the distribution? What is her basis in the distributed assets?

What is the amount and character of Doris's gain or loss on the distribution? What is her basis in the distributed assets?

Definitions:

Q3: A major motive for the acquisition of

Q4: Tyson, a one-quarter partner in the TF

Q12: Super Sadie, Incorporated, manufactures sandals and distributes

Q13: In order to gain a new organizational

Q26: A major disadvantage of legislation to improve

Q28: Porter's "national diamond" framework suggests that a

Q28: Cheyenne Corporation is a U.S. corporation engaged

Q33: The opening quotation from Tom Peters states

Q46: Most multibusiness companies have a dual planning

Q90: Boomerang Corporation, a New Zealand corporation, is