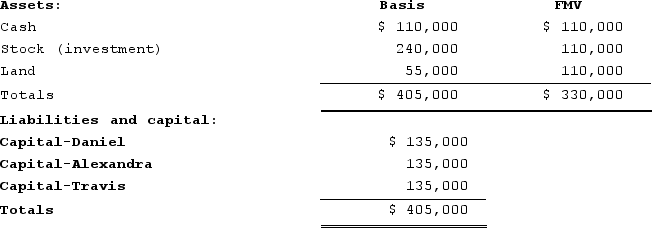

Daniel's basis in the DAT Partnership is $135,000. DAT distributes its land to Daniel in complete liquidation of his partnership interest. DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place, what is the amount and sign (positive or negative) of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

If DAT has a §754 election in place, what is the amount and sign (positive or negative) of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Definitions:

Personally Meaningful Objects

Items that hold significant personal value or emotional significance to an individual.

Delirium

An acute, often fluctuating state of confusion characterized by impaired perception, thinking, and memory.

Impaired Consciousness

A reduced state of awareness where an individual is less responsive to external stimuli, varying from drowsiness to coma.

Q27: In technology-based industries, the most common reason

Q28: When a winery opens a tasting room

Q34: Vertical integration by Zara, the main division

Q35: Economies of scope may be viewed as

Q42: A firm would be unwise to pursue

Q45: According to James Thompson, "pooled interdependence" is

Q48: Heidi and Teresa are equal partners in

Q49: An S corporation shareholder calculates his initial

Q118: Businesses must pay income tax in their

Q137: ABC was formed as a calendar-year S