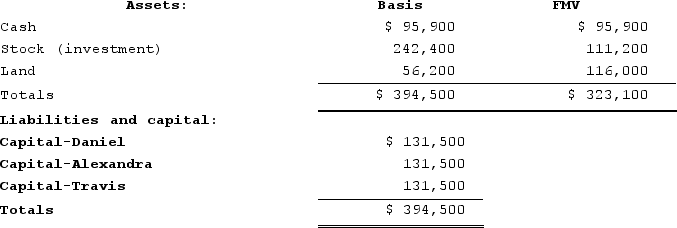

Daniel's basis in the DAT Partnership is $131,500. DAT distributes its land to Daniel in complete liquidation of his partnership interest. DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place, what is the amount and sign (positive or negative) of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

If DAT has a §754 election in place, what is the amount and sign (positive or negative) of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Definitions:

Normally Distributed

Describes a distribution that is symmetric around the mean, bell-shaped, and characterized by its mean and standard deviation.

Mean

The average value of a set of numbers, computed by dividing the sum of these numbers by the count of numbers in the set.

Median

The middle value in a list of numbers, which separates the higher half from the lower half of the dataset.

Normally Distributed

Describes a data set where most values cluster around a central mean value, forming a symmetric, bell-shaped distribution curve.

Q11: "Strategic relatedness" (as distinct from "operational relatedness")

Q26: IBM's decision in the late 1970s to

Q27: Which of the following is not an

Q29: Most of the business models deployed in

Q43: A global strategy involves supplying globally-standardized products.

Q92: ABC Corporation elected to be taxed as

Q100: Parker is a 100percent shareholder of Johnson

Q104: Unlikein partnerships, adjustments that decrease an S

Q117: During the post-termination transition period, property distributions

Q139: Hazel is the sole shareholder of Maple