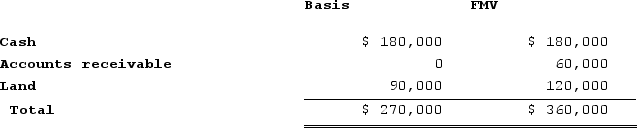

The SSC, a cash-method partnership, has a balance sheetthat includes the following assets on December 31 of the current year:  Susan, a one-third partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $120,000 cash, how much capital gain and ordinary income must Susan recognize from the sale?

Susan, a one-third partner, has an adjusted basis of $90,000 for her partnership interest. If Susan sells her entire partnership interest to Emma for $120,000 cash, how much capital gain and ordinary income must Susan recognize from the sale?

Definitions:

Continuity

The concept that certain properties remain constant over time, despite changes in the container or appearance.

Linear Perspective

Monocular depth perception cue; the tendency for parallel lines to appear to converge on each other.

Motion Parallax

Monocular depth perception cue; the perception of motion of objects in which close objects appear to move more quickly than objects that are farther away.

Reversible

Describing a process or condition that can be returned to its original state or form without permanent damage.

Q3: If a firm is more profitable than

Q9: The three major societal issues that companies

Q22: Internationalization tends to increase competition by increasing

Q25: Jimmy Johnson, a U.S. citizen, is employed

Q32: Zayde is a one-third partner in the

Q39: According to systems theory, high levels of

Q51: Clampett, Incorporated, has been an S corporation

Q52: It may be preferable for government to

Q63: Jenny has a $54,000 basis in her

Q81: Ames Corporation has a precredit U.S. tax