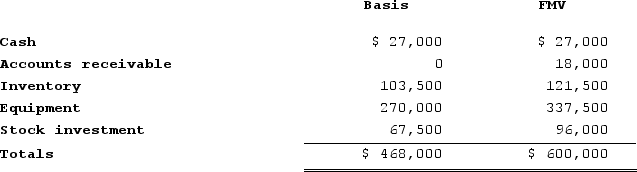

Victor is a one-third partner in the VRX Partnership, with an outside basis of $156,000 on January 1. Victor sells his partnership interest to Raj on January 1 for $200,000 cash. The VRX Partnership has the following assets and no liabilities as of January 1:

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased seven years ago. What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased seven years ago. What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

Definitions:

Relevant Information

Data or details that are pertinent and contribute to a better understanding or decision-making process regarding a specific topic.

Three-step Writing Process

A systematic approach to writing that involves planning, drafting, and revising documents.

Planning

The process of making plans for something, including setting goals and determining the steps necessary to achieve those goals.

Completing

The act of finishing or bringing something to an end.

Q6: ABC was formed as a calendar-year S

Q25: The ability of an innovating firm to

Q38: A firm's competitive advantage is not necessarily

Q40: Franchising offers a means of reconciling the

Q57: After terminating or voluntarily revoking S corporation

Q71: Randolph is a 30percent partner in the

Q80: Federal/state adjustments correct for differences between two

Q83: Holmdel, Incorporated, a U.S. corporation, received the

Q101: Which of the following statements is correct?<br>A)

Q149: At the beginning of the year, Harold,