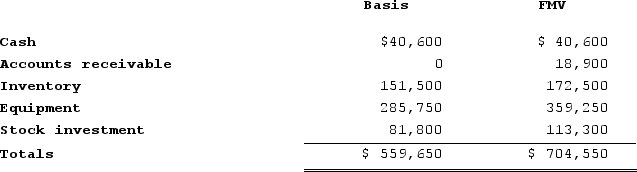

Victor is a one-third partner in the VRX Partnership, with an outside basis of $242,200 on January 1. Victor sells his partnership interest to Raj on January 1 for $291,000 cash. The VRX Partnership has the following assets and no liabilities as of January 1: (Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.)

The equipment was purchased for $381,000 and the partnership has taken $95,250 of depreciation. The stock was purchased seven years ago. What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

The equipment was purchased for $381,000 and the partnership has taken $95,250 of depreciation. The stock was purchased seven years ago. What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

Definitions:

Legislative Changes

Amendments or additions to the laws and statutes by a legislative body, often in response to societal needs or technological advances.

Federal Money

Funds provided by the federal government to states, municipalities, or individuals for projects, programs, or direct assistance.

Environmental Problems

Issues affecting the natural world, often caused or exacerbated by human activity, including pollution, climate change, and biodiversity loss.

Q29: Most of the business models deployed in

Q35: Daniela is a 25percent partner in the

Q36: S corporations without earnings and profits from

Q38: A firm's competitive advantage is not necessarily

Q38: Acquisition is the preferred mode of diversification

Q42: Organizations tend to prefer exploration for new

Q43: Implementing corporate strategy mainly involves the relationships

Q45: To be eligible for the "closer connection"

Q48: Which of the following statements best describes

Q103: Clampett, Incorporated, has been an S corporation