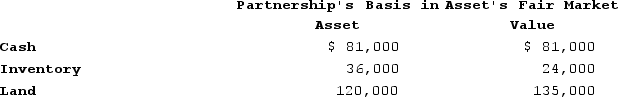

Doris owns a one-third capital and profits interest in the calendar-year DB Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $20,000. On that date, she receives an operating distribution of her share of partnership assets shown below:

What is the amount and character of Doris's gain or loss on the distribution? What is her basis in the distributed assets?

What is the amount and character of Doris's gain or loss on the distribution? What is her basis in the distributed assets?

Definitions:

Job Satisfaction

The degree to which an individual feels content with their job and its various aspects.

Situational Perspective

An approach that considers how external circumstances or environments influence an individual's behavior, feelings, and thoughts.

Accommodate

In a social context, to adjust one's behavior or expectations to be more compatible with others or to meet their needs.

Warm-hearted

Having or showing kindness, empathy, and genuine care for others, characterized by a compassionate nature.

Q3: The main purpose of a portfolio planning

Q20: The intellectual property of a firm comprises:<br>A)Copyright

Q26: Suppose that at the beginning of 2020

Q33: The firm which sets the dominant product

Q36: The principal feature of the corporate scope

Q38: Russell Starling, an Australian citizen and resident,

Q49: Corporations are not the dominant organizational form

Q50: "Experience goods" are those which:<br>A)Have performance attributes

Q72: The Mobil decision identified three factors to

Q97: Wacky Wendy produces gourmet cheese in Wisconsin.