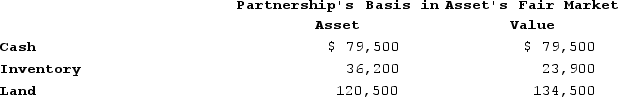

Doris owns a one-third capital and profits interest in the calendar-year DB Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $20,100. On that date, she receives an operating distribution of her share of partnership assets shown below:

What is the amount and character of Doris's gain or loss on the distribution? What is her basis in the distributed assets?

What is the amount and character of Doris's gain or loss on the distribution? What is her basis in the distributed assets?

Definitions:

Informal Deviance

Behaviors that violate informal social norms or expectations, which are not codified into law.

Legal Code

A coherent set of laws that are systematically arranged, usually by the government or other regulatory authority.

Differential Association Theory

Theory that interprets deviance as behavior one learns through interaction with others.

Culturally Transmitted

The process by which knowledge, beliefs, values, and behaviors are passed from one generation to the next within a society.

Q8: The mechanisms through which the corporate headquarters

Q33: The main strategy implication of the Boston

Q37: Tyco International's decision to split into three

Q40: Marcella has a $65,000 basis in her

Q56: According to Charles Darwin it is the

Q69: When an S corporation distributes appreciated property

Q70: A partner recognizes a loss when she

Q96: Hoosier Incorporated is an Indiana corporation. It

Q97: Wacky Wendy produces gourmet cheese in Wisconsin.

Q109: MWC is a C corporation that uses