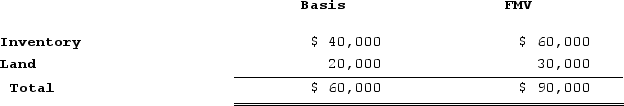

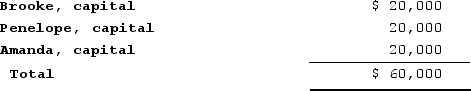

BPA Partnership is an equal partnership in which each of the partners has a basis in her partnership interest of $20,000. BPA reports the following balance sheet:

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

b. Are these assets "hot" for purposes of distributions?

c. If BPA distributes the land to Brooke in complete liquidation of her partnership interest, what tax issues should be considered?

Definitions:

Modeling

A social learning theory concept where individuals learn behaviors, attitudes, or emotions through observing others.

Therapy

A general term for treatments and interventions designed to alleviate emotional distress, psychological disorders, and promote mental health and well-being.

Unconscious Resistances

Psychological defense mechanisms that prevent certain thoughts, feelings, or desires from entering conscious awareness.

Self-efficacy

A person's belief in their ability to succeed in specific situations or accomplish a task.

Q9: Spartan Corporation, a U.S. company, manufactures widgets

Q20: Complementarity research should not be used by

Q28: Competitive advantage can be defined as:<br>A)A firm's

Q35: Organizational identity refers to:<br>A)A collective understanding among

Q44: Windmill Corporation, a Dutch corporation, is owned

Q59: Suppose a calendar-year C corporation, NewCorp, Incorporated,

Q99: Jackson is the sole owner of JJJ

Q112: SoTired, Incorporated, a C corporation with a

Q133: An S corporation shareholder's allocable share of

Q157: J.D. formed Clampett, Incorporated, as a C