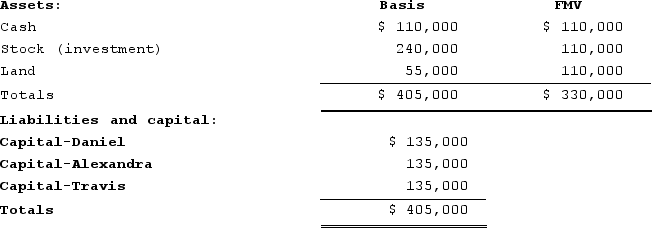

Daniel's basis in the DAT Partnership is $135,000. DAT distributes its land to Daniel in complete liquidation of his partnership interest. DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place, what is the amount and sign (positive or negative) of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

If DAT has a §754 election in place, what is the amount and sign (positive or negative) of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Definitions:

Supreme Court

The highest judicial court in a country or state, such as the United States Supreme Court, which has ultimate appellate jurisdiction.

Suburban Homeownership

The trend of owning a private home in suburban areas, characterized by lower population density and more spacious living conditions than urban centers.

Poverty Rate

A statistical measure reflecting the percentage of the population living below the poverty line, based on income, family size, and other factors.

Southern Christian Leadership Conference

An African-American civil rights organization founded in 1957, which played a major role in the American civil rights movement.

Q20: For high-tech products such as aircraft and

Q21: Daniela is a 25percent partner in the

Q36: S corporations without earnings and profits from

Q41: The fact that a firm's "activity system"

Q47: The shared values embodied in an organization's

Q51: Pre-emption strategies can help sustain a firm's

Q52: Santa Fe Corporation manufactured inventory in the

Q82: Mahre, Incorporated, a New York corporation, runs

Q94: Jesse Stone is a citizen and bona

Q125: Gordon operates the Tennis Pro Shop in