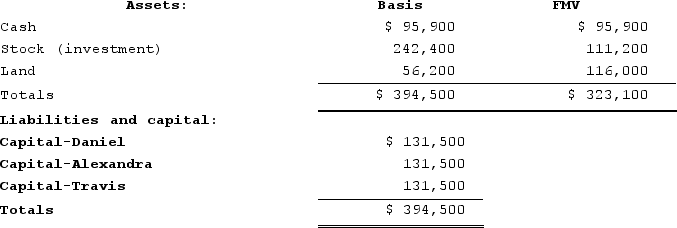

Daniel's basis in the DAT Partnership is $131,500. DAT distributes its land to Daniel in complete liquidation of his partnership interest. DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place, what is the amount and sign (positive or negative) of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

If DAT has a §754 election in place, what is the amount and sign (positive or negative) of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Definitions:

Internal Staff

Employees who work within an organization, as opposed to external contractors or consultants, contributing to its operations, culture, and goals.

Outsourcing

The business practice of hiring external firms to handle certain jobs or services instead of performing them in-house.

Canadian Firms

Entities based in Canada engaged in commercial, industrial, or professional activities.

HR Functions

Activities and responsibilities carried out by the human resources department, including recruitment, training, employee relations, and performance management.

Q3: The annual value of rented property is

Q12: To develop and deploy the broad range

Q14: If a firm pays closely to the

Q17: Most of the biggest mergers and acquisitions

Q20: Daniela is a 25percent partner in the

Q23: Of the two sources of superior profitability,

Q35: The main parallel between the merger boom

Q44: With the onset of maturity, industries often

Q100: Lola is a 35percent partner in the

Q103: Portsmouth Corporation, a British corporation, is a