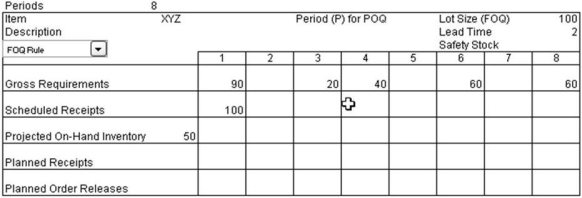

Complete the following MRP record using the FOQ rule:

Definitions:

Marginal Tax Rate

The rate at which the last dollar of income is taxed, reflecting the percentage of additional income that must be paid in taxes.

Average Tax Rate

The ratio of the total amount of taxes paid by an individual or business to the total income or profit earned.

Fiscal Year

A twelve-month period used for accounting and financial reporting purposes, which may or may not align with the calendar year.

Unfunded Mandate

A statute or regulation that requires a state or local government to perform certain actions, with no money provided for fulfilling the requirements.

Q4: Tax policy rarely plays an important part

Q12: Which one of the following statements about

Q17: A responsive supply chain typically has:<br>A) a

Q26: A(n) _ is an intermediate item that

Q59: _ is the degree to which a

Q60: Pho Bulous, a Vietnamese restaurant in the

Q65: The purpose of supply chain design is

Q76: A(n) _ is a record that divides

Q94: Operations produces a number of items in

Q128: Combination forecasting is most effective when the