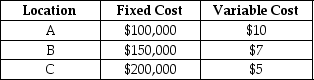

Table 13.8

An operations manager has narrowed down the search for a new plant for Tim! to three locations. Fixed and variable costs follow.

-Excel Products is planning a new warehouse to serve the Southeast. Locations A, B, and C are under consideration. Fixed and variable costs follow.

Which of the following statements is best?

Definitions:

Q1: Selling expenses, fixed expenses and depreciation are

Q2: Use the information in Table 10.1. Which

Q7: Leonardo, who is married but files separately,

Q20: Supply chain integration is the effective coordination

Q41: A quantitative method used to evaluate multiple

Q72: _ uses a firm's flexible processes to

Q73: The total amount of greenhouse gasses produced

Q90: Jackson Sheds has four different warehouse configurations

Q112: Margaret was issued a $150 speeding ticket.

Q120: A new product development team that is