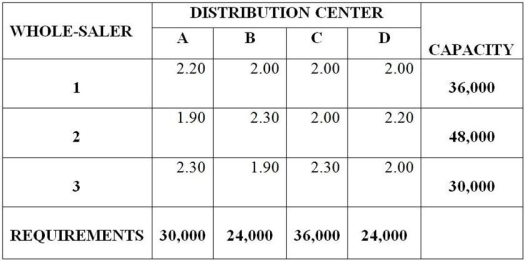

Table 13.11

The Neale Company has four distribution centers (A, B, C, and D) that require monthly shipments of 30,000, 24,000, 36,000, and 24,000 gallons of diesel fuel per month, respectively. Three wholesalers (1, 2, and 3) are willing to supply up to 36,000, 48,000 and 30,000 gallons, respectively. Total costs (in $) for both shipping and price per gallon follow. A transportation method tableau is provided below.

-Use the information in Table 13.11. What can be said about a plan that ships 30,000 gallons from 1 to A; 6,000 gallons from 1 to C; 24,000 gallons from 2 to B; 24,000 gallons from 2 to D; and 30,000 gallons from 3 to C?

Definitions:

General Partners

Individuals in a partnership who are responsible for the management of the partnership and are liable for its debts.

Foreign Limited Partnerships

Partnerships formed in one jurisdiction but doing business in another where the liability of some partners is limited.

Low-profit Limited Liability Company

A classification of LLC that combines the legal and tax flexibility of a traditional LLC, the social benefits of a nonprofit organization, and a commitment to limited profit distribution.

Socially Beneficial

Refers to actions, policies, or practices that have a positive impact on society or the community as a whole.

Q1: A take back incentive by a company

Q7: Suppliers can gain power from a number

Q15: It is desirable for a firm in

Q40: The demand forecast for the next four

Q51: The competitive orientation to supplier relations is

Q61: The _ process involves the activities required

Q67: Complete the following MRP record using the

Q79: The conversion strategy capitalizes on the fact

Q81: A taxpayer can avoid a substantial understatement

Q117: Use Scenario 11.2 to answer this question.