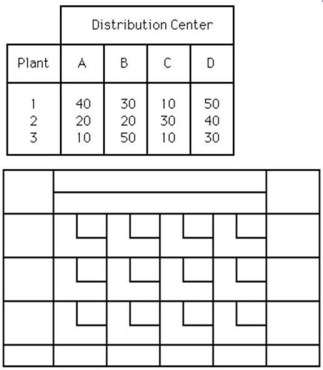

The Nelson Company has four distribution centers (A, B, C, and D) that require shipments of 20, 30, 40, and 10 units per week, respectively. Its three plants (1, 2, and 3) have monthly capacities of 40, 30, and 30, respectively. Shipping costs (in $) follow.

Definitions:

Outstanding Receivables

are amounts owed to a business by its customers for goods or services delivered but not yet paid for.

FMV

Fair Market Value; the price that property would sell for on the open market between a willing buyer and a willing seller.

Basis

In tax terms, it refers to the amount of a taxpayer's investment in property for tax purposes, used to calculate gain or loss on the sale or disposition of the property.

Inventory

Assets that are held for sale in the ordinary course of business, or in the process of being produced for such sale, or in the form of materials to be consumed in the production process.

Q14: One benefit of a sin tax (e.g.,

Q27: The weeks of supply measure will improve

Q36: A store has collected the following information

Q40: Virtually every transaction involves the taxpayer and

Q44: ISO 14001:2004 standards require that companies must

Q94: For the following tax returns, identify the

Q97: Jeremy has a new client. He has

Q98: What is the explosion of the MPS

Q110: Which of the following is not an

Q168: An assistant manager is reviewing the costs