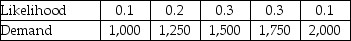

Jackson Sheds has four different warehouse configurations under study, ranging from four warehouses to seven warehouses (only integer values). Each warehouse has a capacity of 200 units and costs $200 to maintain over the course of a year. Demand can range from 1,000 units per year up to 2,000 units in increments of 250 units. If the system warehouse capacity is sufficient to handle the year's demand, then the per unit cost is $2 per unit, but if the warehouse capacity is insufficient, the per unit cost for each unit in excess of system capacity is $3 per unit. The likelihood for each possible demand is shown in the table.

Which warehouse configuration is best for Jackson Sheds?

Definitions:

Fixed Costs

Expenses that remain constant regardless of the level of output or sales, including rent, wages, and insurance costs.

Margin of Safety

The difference between actual or expected sales and sales at the break-even point. It measures how close a company is to not covering its fixed costs.

Break-even Sales

The amount of revenue from sales that exactly covers the fixed and variable costs of producing and selling a product, with no profit or loss.

Pretax Net Income

The amount of money a company has earned before taxes are deducted.

Q34: Which is not a basic tax planning

Q42: Which of the following statements about MRP

Q59: Use the information in Table 10.6. What

Q72: Refer to Matrix 15.1. What is the

Q73: The effective tax rate, in general, provides

Q74: Widgets, Inc. wishes to locate two new

Q81: Which of the following statements about service

Q81: A taxpayer can avoid a substantial understatement

Q105: Which of the following is needed to

Q120: A hospital must have a skeleton crew