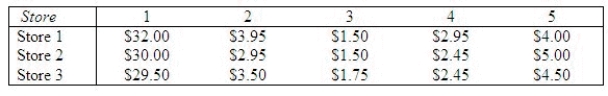

A consumer was interested in determining whether there is a significant difference in the price charged for tools by three hardware stores. The consumer selected five tools and recorded the price for each tool in each store. The following data was recorded:  Fmodel = ______________

Fmodel = ______________

p-value = ______________

Ftool = ______________

p-value = ______________

Fstore = ______________

p-value = ______________

______________

Definitions:

Proportional Tax

A tax system where the tax rate remains constant regardless of the amount subject to tax, meaning everyone pays the same percentage of their income.

Progressive Tax

A tax system where the tax rate increases as the taxable amount increases, burdening wealthier individuals more.

Progressive Tax

A tax system in which tax rates increase as the taxable amount increases, placing a higher tax burden on individuals with higher incomes.

Regressive Tax

A tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases, disproportionately affecting lower-income individuals.

Q3: The p-value is usually 0.025.

Q5: In regression analysis, if the values of

Q31: A union composed of several thousand employees

Q45: In testing the significance of a multiple

Q65: A multiple regression equation includes 5 predictor

Q91: Tukey's method for paired comparisons assumes that

Q93: A major department store chain is interested

Q138: In a randomized block design of ANOVA,

Q168: A random sample of size n has

Q173: In multiple regression analysis, which procedure permits