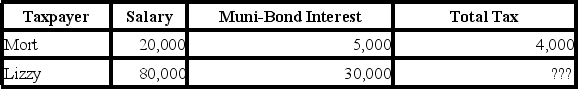

Given the following tax structure, what is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to average tax rates? What is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to effective tax rates?

Definitions:

Abbreviated

Refers to shortened or condensed forms of words, terms, or documents, often used to save space or time.

Revenue Accounts

Accounts used to record the income generated from a company's primary operations.

Credit Balance

A situation where the amount of credits in an account exceeds the debits, signifying an amount owed to the account holder.

Accounts Payable

Liabilities representing amounts owed by a company to creditors for goods and services that have been purchased or received but not yet paid for.

Q1: Selling expenses, fixed expenses and depreciation are

Q10: The more sophisticated the application of additive

Q26: The Bahouth Bike Company has completed an

Q33: Assume that Lavonia's marginal tax rate is

Q42: Geographical Information System (GIS) tools are useful

Q43: A shipment that is transported using two

Q45: Sheri and Jake Woodhouse have one daughter,

Q66: Based only on the information provided for

Q84: Which of the following statements regarding dependents is

Q91: All investment expenses are itemized deductions.