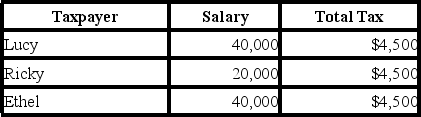

Consider the following tax rate structures. Is it horizontally equitable? Why or why not? Is it vertically equitable? Why or why not?

Definitions:

Donated Land

This informs the recording of land gifted to an entity, valued at its fair market value at the time of donation as an asset on the balance sheet.

Donated Machinery

Assets received for free by an entity, where the fair market value of the machinery is recorded as both income and an asset on the balance sheet.

Volunteer Hours

The amount of time individuals spend performing unpaid services for nonprofit organizations or community projects.

Restricted Fund Method

An accounting practice where funds specified for certain purposes are kept separate in financial records to ensure their use only for those purposes.

Q1: Which of the following increases the benefits

Q13: Oswald is beginning his first tax course

Q19: The estate tax is assessed based on

Q21: Temporary Regulations have more authoritative weight than

Q26: What's the difference between postponement and channel

Q48: Which of the following audits is the

Q52: The tax base for the federal income

Q52: Bonnie and Ernie file a joint return.

Q78: The timing strategy becomes more attractive if

Q99: Critical mass is a situation whereby several