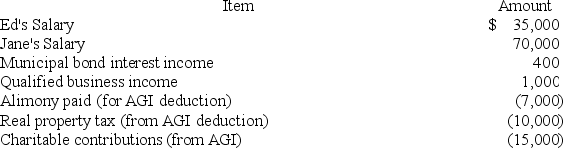

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What is the couple's adjusted gross income?

Definitions:

Ecological Pyramids

Graphical representations showing the relative amounts of energy or matter contained within each trophic level in a given ecosystem.

Pyramid of Numbers

A graphical representation showing the number of organisms at different trophic levels in an ecosystem, typically decreasing from producers to top predators.

Photosynthesis

The process by which green plants and certain other organisms transform light energy into chemical energy, using carbon dioxide and water to produce glucose and oxygen.

Animal Respiration

The process by which animals exchange gases with their environment, taking in oxygen and releasing carbon dioxide, typically involving lungs or gills.

Q15: Jane and Ed Rochester are married with

Q21: Which of the following items is not

Q28: For each of the following, determine if

Q33: Bunching itemized deductions is one form of

Q61: When selling stocks, which method of calculating

Q77: Self-employed taxpayers can deduct the cost of

Q78: Earl and Lawanda Jackson have been married

Q90: Given the following tax structure, what is

Q97: Excess business losses are carried back and

Q98: The timing strategy is based on the