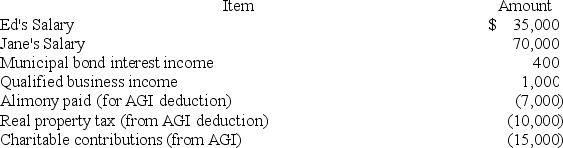

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What is the couple's taxable income?

Definitions:

Selling Price

The amount a seller charges a buyer for a product or service, determined by various factors including cost, demand, and competition.

Variable Overhead Costs

Overhead costs that fluctuate with the level of production activity, such as utilities for the manufacturing plant.

Operating Capacity

The maximum output or productivity level that a company can achieve using its current resources under normal working conditions.

Fixed Overhead Costs

Expenses that do not change with the level of production, such as rent or salaries of administrative staff.

Q3: In February of 2017, Lorna and Kirk

Q20: Irene's husband passed away this year. After

Q23: The IRS DIF system checks each tax

Q52: Bonnie and Ernie file a joint return.

Q65: Tax credits reduce a taxpayer's taxable income

Q91: Excise taxes are typically levied on the

Q106: The goal of tax planning generally is

Q107: Which of the following is an example

Q109: Simon was awarded a scholarship to attend

Q109: Mary Ann is working on a pretty