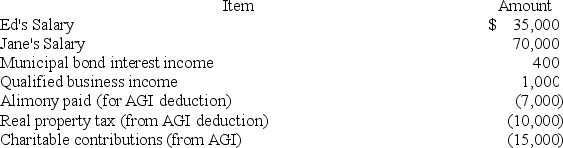

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What are the couple's taxes due or tax refund (use the tax rate schedules not tax tables)?

Definitions:

Retained Earnings

The portion of a company's profits that is held or retained and saved for future use, investments, or to pay debt, rather than distributed to shareholders as dividends.

Adjusted Trial Balance

A statement listing all accounts and their final balances after adjusting entries are made, used to prepare financial statements.

Closing Entries

Journal entries made at the end of an accounting period to transfer the balances of temporary accounts to permanent ones.

Retained Earnings Account

An equity account that represents the accumulated portion of net income that a company retains after distributing dividends to shareholders.

Q4: Rhett made his annual gambling trip to

Q4: Tax policy rarely plays an important part

Q5: A fiscal tax year can end on

Q11: This year Henry realized a gain on

Q18: Which of the following represents the largest

Q25: Manny, a single taxpayer, earns $65,000 per

Q32: When the wash sale rules apply, the

Q44: This year, Jong paid $3,000 of interest

Q87: Earmarked taxes are:<br>A) taxes assessed only on

Q124: In certain circumstances a child with very