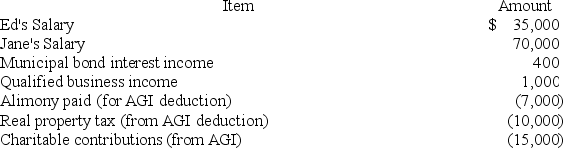

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What is the couple's gross income?

Definitions:

Variability

The degree to which data points in a dataset differ from each other and from the average.

Ecosphere

An ecological sphere; a concept encompassing all living organisms and their physical environment on the planet.

Sustainable Timber

Timber harvested in a way that maintains the forest's biodiversity, productivity, and ecological processes over the long term.

Widespread Destruction

Extensive damage or devastation covering a large area, often due to natural disasters or human activities.

Q17: The assignment of income doctrine is a

Q37: Scott is a self-employed plumber and his

Q60: Simone donated a landscape painting (tangible capital

Q69: Fran purchased an annuity that provides $12,000

Q83: In a proportional (flat) tax rate system,

Q85: The principle of realization for tax purposes

Q87: If Julius has a 30% tax rate

Q96: Property taxes may be imposed on both

Q107: This year Ann has the following stock

Q109: Jackson has the choice to invest in