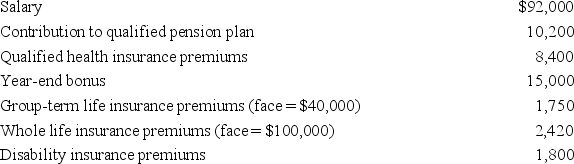

Andres has received the following benefits this year.

Besides these benefits Andres missed work for two months due to an illness. During his illness Andres received $6,500 in sick pay from a disability insurance policy. Assume Andres has disability insurance provided by his employer as a nontaxable fringe benefit. What amount, if any, must Andres include in gross income this year?

Definitions:

Hypnosis

A trance-like state of focus and concentration achieved with the help of a therapist, used for therapeutic purposes.

Brain Imaging

The use of various techniques to visually capture the structure or function of the brain, often used for diagnostic or research purposes.

Altered Consciousness

A change in one’s normal mental state, possibly due to drugs, trauma, meditation, or sleep deprivation.

FDA

The Food and Drug Administration, a government agency responsible for regulating food, drugs, medical devices, and other health-related products in the United States.

Q17: When electing to include preferentially-taxed capital gains

Q33: Assume that Lavonia's marginal tax rate is

Q38: Generally, 85 percent of Social Security benefits

Q44: Assume that Joe (single) has a marginal tax

Q46: In April of year 1, Martin left

Q61: Which of the following is a True

Q72: Parents may claim a $2,000 child tax

Q79: How is the recovery period of an

Q99: Which of the following assets are eligible

Q105: As required by the Constitution, all tax