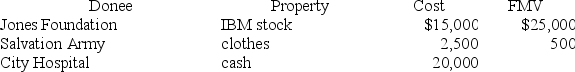

This year Latrell made the following charitable contributions:

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting has been owned for 10 years.

Definitions:

Symmetry

The property of being made up of exactly similar parts facing each other or around an axis; often evaluated in statistical data sets.

Normal Distribution

A symmetrical, bell-shaped distribution of data wherein most observations cluster around the central peak and probabilities for values taper off equally in both directions.

Mean

The arithmetic average of a set of values, calculated by summing all the values and then dividing by the number of values.

Normal Curve

A bell-shaped curve that represents the distribution of a set of data where most values cluster around the mean.

Q1: This year Clark leased a car to

Q17: Sheryl's AGI is $250,000. Her current tax

Q50: In addition to the individual income tax,

Q59: Eric and Josephine were married in year

Q65: Which of the following is a True

Q84: §1239 recharacterizes 50 percent of the gain

Q95: A loss realized for property destroyed in

Q96: The deduction for investment interest in excess

Q104: Poplock LLC purchased a warehouse and land

Q117: When a taxpayer sells an asset, the