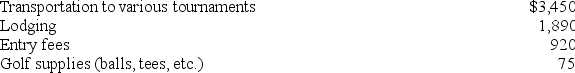

Detmer is a successful doctor who earned $204,800 in fees this year, but he also competes in weekend golf tournaments. Detmer reported the following expenses associated with competing in almost a dozen tournaments:

This year Detmer won $5,200 from competing in various golf tournaments. Assuming that Detmer itemizes his deductions and that he did not have any other miscellaneous itemized deductions, what amount of the golfing expenses are deductible after considering all limitations if the tournament golfing is treated as a hobby activity?

Definitions:

Enforceable

Describes a legal agreement or contract that can be upheld or compelled by law or by a court.

Covenant Not To Compete

A contractual promise to refrain from competing with another party for a certain period of time and within a certain geographic area. Although covenants not to compete restrain trade, they are commonly found in partnership agreements, business sale agreements, and employment contracts. If they are ancillary to such agreements, covenants not to compete will normally be enforced by the courts unless the time period or geographic area is deemed unreasonable.

Restriction

A restriction refers to a limitation or condition placed on the use, development, or transfer of property or rights.

Intoxicated

A state of being under the influence of drugs or alcohol to the extent that mental and physical capabilities are significantly impaired.

Q7: Tax savings generated from deductions are considered

Q35: Accounts receivable and inventory are examples of

Q52: Given that losses from passive activities can

Q54: The constructive receipt doctrine is a natural

Q55: Bill operates a proprietorship using the cash

Q59: Which of the following is a True

Q59: The investment interest expense deduction is limited

Q78: Fred must include in gross income a

Q86: If Jim invested $100,000 in an annual-dividend

Q114: Which of the following relationships does NOT