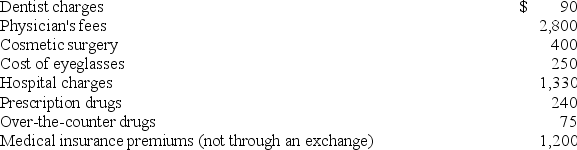

Jenna (age 50) files single and reports AGI of $40,000. This year she has incurred the following medical expenses:

Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Definitions:

Petty Cash Voucher

A document used to log and authorize the use of petty cash funds for small, incidental expenses.

Cash Short

A situation where the recorded cash amount is less than the expected amount, often due to errors or theft.

Petty Cash

A small fund kept on hand used for minor, miscellaneous expenses of a business.

Q7: Henry, a single taxpayer with a marginal

Q28: Which taxpayer would not be considered a

Q30: Looking at the following partial calendar for

Q33: To calculate a gain or loss on

Q38: Which of the following expenses are completely

Q60: Judy, a single individual, reports the following

Q73: The timing strategy is particularly effective for

Q102: Boot is not like-kind property involved in

Q112: Kodak is a beginning tax researcher. He

Q142: Which of the following statements about estimated