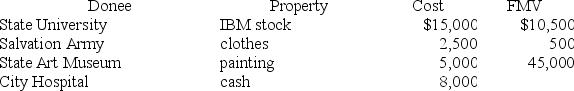

This year Darcy made the following charitable contributions:

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum consistent with museum's charitable purpose.

Definitions:

Common Shares

Equity securities that represent ownership in a corporation, entitling holders to vote on corporate matters and share in the profits through dividends.

Share Capital

The amount of money raised by a company through the sale of shares to investors, representing ownership in the company.

Retained Earnings

The portion of a company's profits that is kept or retained and not paid out as dividends to shareholders.

Secondary Market

The marketplace where investors buy and sell securities or assets from other investors, rather than from the issuing companies directly.

Q20: In general, a taxpayer should select longer-lived

Q29: The profit motive distinguishes "business" activities from

Q69: Which of the following may limit the

Q70: Realized income is included in gross income

Q83: All of the following are tests for

Q85: Rachel is an engineer who practices as

Q94: For the following tax returns, identify the

Q103: Reid acquired two assets in 2018: computer

Q112: Future value can be computed as Future

Q113: Tax credits reduce taxable income dollar for