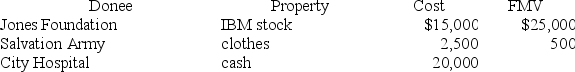

This year Latrell made the following charitable contributions:

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting has been owned for 10 years.

Definitions:

Conception

The process of fertilization where a sperm cell unites with an egg cell, leading to the formation of a zygote.

Dependency

A state of relying on or being controlled by someone or something else.

Cultural Transmission

The process by which norms, values, knowledge, and skills are passed from one generation to the next within a society.

Learning

The process of acquiring knowledge or skills through experience, study, or being taught, leading to a lasting change in behavior or understanding.

Q8: Assume that Bethany acquires a competitor's assets

Q30: Michael, Diane, Karen, and Kenny provide support

Q47: Unreimbursed employee business expenses and hobby expenses

Q49: An individual may be considered as a

Q52: Given that losses from passive activities can

Q54: The constructive receipt doctrine is a natural

Q70: All taxpayers may use the §179 immediate

Q72: If Lucy earns a 6% after-tax rate

Q83: Campbell, a single taxpayer, has $95,000 of

Q123: Robert will be working overseas on a