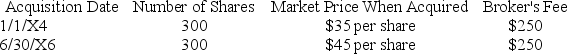

On December 1, 20X7, George Jimenez needed a little extra cash for the upcoming holiday season, and sold 250 shares of Microsoft stock for $50 per share less a broker's fee of $200 for the entire sale transaction. Prior to the sale, George held the following blocks of Microsoft stock (associated broker's fee paid at the time of purchase): (Do not round intermediate calculations.)

If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

Definitions:

Hormones

Chemical messengers secreted by glands in the body that regulate physiology and behavior, including growth, metabolism, and reproductive processes.

Bloodstream

The flowing blood within the circulatory system of the body, carrying oxygen, nutrients, and waste products to and from the cells.

Synaptic Gaps

The tiny space between neurons across which neurotransmitters travel to transmit signals from one neuron to another.

Limbic System

Neural system (including the hippocampus, amygdala, and hypothalamus) located below the cerebral hemispheres; associated with emotions and drives.

Q8: A short tax year can end on

Q28: Taxpayers may elect to deduct state and

Q29: Interest earned on U.S. savings bonds is

Q29: Which of the following would be considered

Q34: Jasmine and her husband Arty have been

Q48: Clyde operates a sole proprietorship using the

Q56: The test for whether an expenditure is

Q58: Jayzee is a single taxpayer who operates

Q100: The general rule regarding the exchanged basis

Q100: The Tanakas filed jointly in 2018. Their