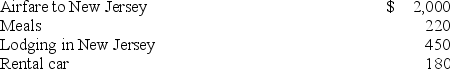

Shelley is employed in Texas and recently attended a two-day business conference at the request of her employer. Shelley spent the entire time at the conference and documented her expenditures (described below) . What amount can Shelley deduct if she is not reimbursed by her employer?

Definitions:

Dominant Firm Oligopoly

A market structure in which a single firm has a predominant share of the total market, and the actions of this firm significantly influence the entire market's dynamics.

Industrial Regulation

Governmental regulation of industries to control and monitor their activities for the public good, often to ensure competition and prevent monopolies.

Natural Monopolies

A market structure in which a single supplier is the most efficient at delivering goods or services due to unique circumstances, often regulated by the government.

Market Power

The ability of a firm or entity to influence the price and production levels within a market.

Q7: To qualify as a charitable deduction the

Q16: Brandy sold a rental house that she

Q21: Which of the following types of transactions

Q23: If tangible personal property is depreciated using

Q53: If a married couple has one primary

Q59: The investment interest expense deduction is limited

Q67: Both traditional 401(k) plans and Roth 401(k)

Q73: Assume Georgianne underpaid her estimated tax liability

Q80: An asset's tax adjusted basis is usually

Q105: Which of the following is not True