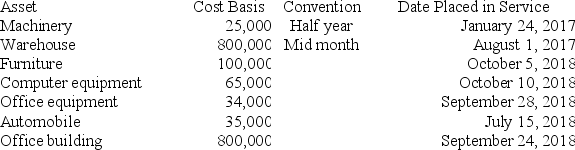

Boxer LLC has acquired various types of assets recently used 100% in its trade or business. Below is a list of assets acquired during 2017 and 2018:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2017, but would like to take advantage of the §179 expense and bonus depreciation for 2018 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation expense for 2018. (Use MACRS Table 1, Table 5 and Exhibit 10-10 ) (Round final answer to the nearest whole number.)

Definitions:

Hypocalcemia

A medical condition characterized by abnormally low calcium levels in the blood, which can cause neurological issues.

Cardiac Arrhythmias

are irregular heartbeats that can be too fast, too slow, or erratic, disrupting normal heart rhythm and function.

Muscular Weakness

A decrease in the strength of one or more muscles, potentially affecting physical performance and daily activities.

Parathyroid Hormone

A hormone secreted by the parathyroid glands that regulates calcium levels in the body through its effects on bone, kidney, and intestine.

Q13: Which of the following statements regarding the

Q17: Jim operates his business on the accrual

Q20: Campbell, a single taxpayer, has $400,000 of

Q30: Santa Fe purchased the rights to extract

Q33: The child tax credit is subject to

Q39: The computation of the alternative minimum tax

Q92: Daniela retired at the age of 65.

Q98: During 2018, Jasmine (age 12) received $6,500

Q99: A business generally adopts a fiscal or

Q100: Henry has been working for Cars Corp.