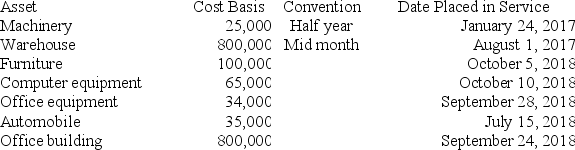

Boxer LLC has acquired various types of assets recently used 100% in its trade or business. Below is a list of assets acquired during 2017 and 2018:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2017, but would like to take advantage of the §179 expense and bonus depreciation for 2018 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation expense for 2018. (Use MACRS Table 1, Table 5 and Exhibit 10-10 ) (Round final answer to the nearest whole number.)

Definitions:

Mass Transit

Public transportation systems that move large numbers of people within urban and suburban areas.

Price of Gasoline

The cost per unit volume of gasoline, typically measured in dollars per gallon or liters.

Equilibrium Price

The price at which the quantity of a product demanded by consumers and the quantity supplied by producers are equal.

Oat Bran

The outer layer of the oat grain, rich in dietary fiber and nutrients, often consumed for its health benefits, such as lowering cholesterol.

Q1: Which of the following is not an

Q6: The tax rate schedules are set up

Q8: Which of the following statements regarding personal

Q41: Mr. and Mrs. Smith purchased 100 shares

Q43: Harvey rents his second home. During the

Q48: Corinne's employer offers a cafeteria plan that

Q50: A loss deduction from a casualty of

Q72: Kaylee is a self-employed investment counselor who

Q85: Hope's employer is now offering group-term life

Q93: John is a self-employed computer consultant who