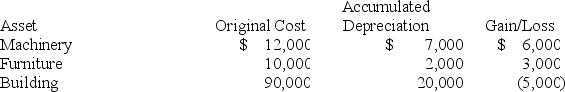

Andrew, an individual, began business four years ago and has never sold a §1231 asset. Andrew owned each of the assets for several years. In the current year, Andrew sold the following business assets:

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Definitions:

Exercise

Physical activity that is planned, structured, repetitive, and aimed at improving or maintaining physical fitness and overall health.

Independent Variable

The variable in an experiment that is manipulated or changed by the researcher to observe its effects on the dependent variable.

Demeanor

The outward behavior or bearing of a person, indicating their character or mood.

One-way Mirror

A piece of glass that is a mirror on one side but can be seen through like a window from the other, often used in psychological research or police lineups.

Q4: Gabby operates a pizza delivery service. This

Q18: Bateman Corporation sold an office building that

Q31: For corporations, §291 recaptures 20 percent of

Q33: The manner in which a business amortizes

Q47: Marilyn operates a day care center as

Q52: Given that losses from passive activities can

Q73: Assume Georgianne underpaid her estimated tax liability

Q83: Bull Run sold a computer for $1,200

Q91: The amount of expenditures eligible for the

Q115: Darren is eligible to contribute to a